Efficient financial operations are essential for success, and Accounts Payable (AP) services play a pivotal role in ensuring accurate and timely vendor payments. Bill Accounting specializes in outsourcing accounting services, offering a suite of AP services that leverage cutting-edge technology. Our expert team manages payables meticulously, from invoice receipt to payment processing, ensuring compliance and transparency. Robust AP services not only protect against fraud and errors but also foster strong vendor relationships and optimize working capital for sustained business growth. Bill Accounting goes beyond payment processing; we create a seamless financial ecosystem, enhancing operational capabilities and supporting your business goals. Explore the intricacies of invoice management, supplier relations, payment processing, and AP automation with Bill Accounting for transformative financial efficiency.

Accounts Payable Services encompass a broad range of functions essential to the financial health and operational efficiency of businesses. At its core, accounts payable refers to the money that a company owes its suppliers and creditors, a critical aspect of managing business finances. Effective management of these services is not just about paying bills; it's about optimizing the entire process from invoice receipt to payment, ensuring accuracy, efficiency, and compliance.

The Role of Accounts Payable in Business Operations

Accounts payable services play a pivotal role in managing a company's cash outflows. They involve various tasks, including invoice processing, vendor payments, dispute resolution, and maintaining vendor relations. A well-managed AP function ensures that all payments are made accurately and on time, which is crucial for maintaining good relationships with suppliers and avoiding late fees or penalties.

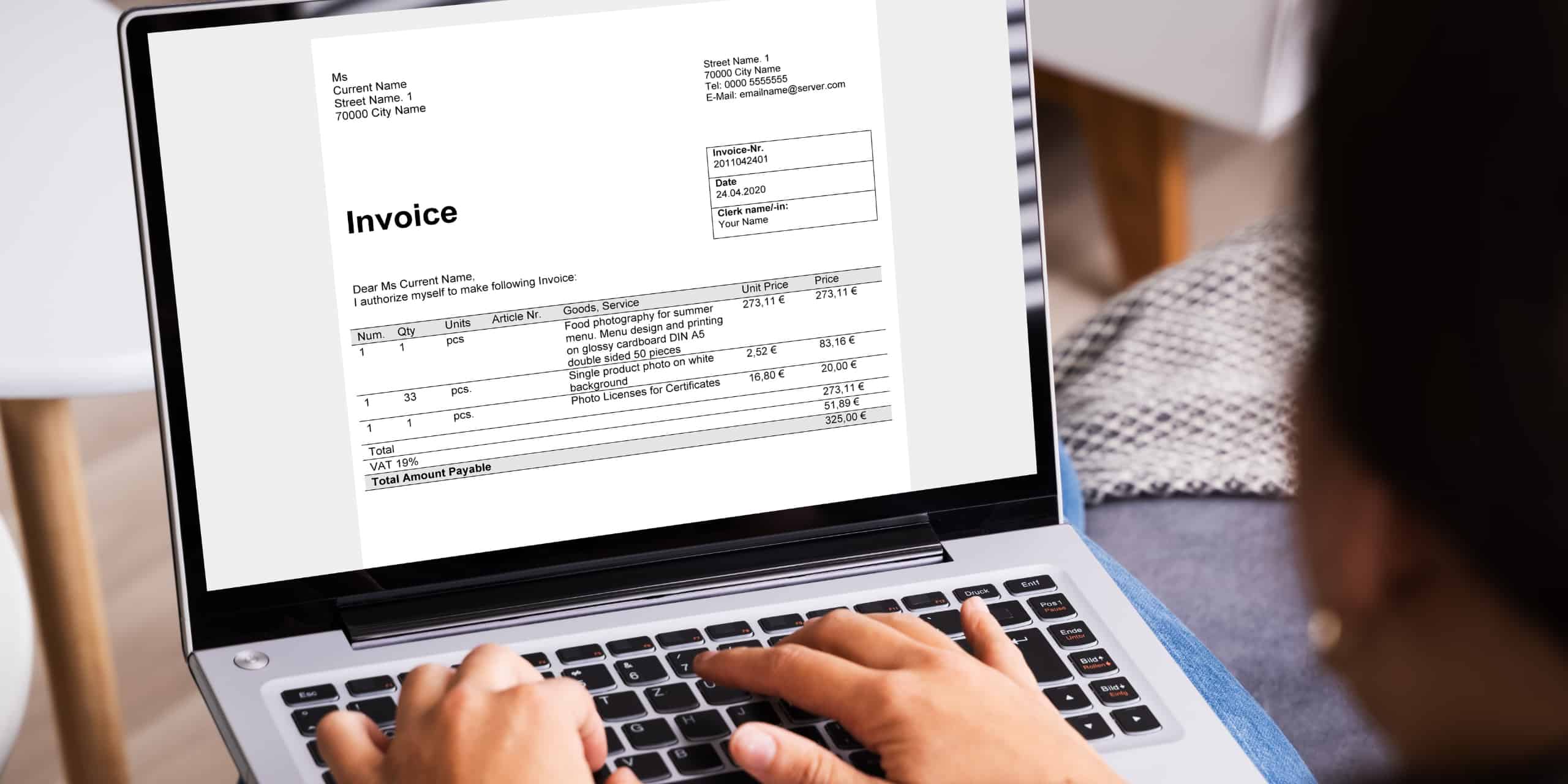

Invoice Management: The First Step in AP Services

The process begins with invoice management, which involves receiving, processing, and paying vendor invoices. This step is critical as it sets the foundation for effective payables management. Proper invoice management ensures that all invoices are accounted for, validated, and processed in a timely manner. It involves verifying invoice details, such as amounts, terms, and purchase orders, and ensuring they match the goods or services received.

The Benefits of Effective Accounts Payable Management

Effective management of accounts payable services offers numerous benefits. It enhances operational efficiency by reducing manual tasks and streamlining processes. It also improves financial control by providing real-time visibility into cash flow and liabilities, enabling better financial decision-making. Moreover, strong AP practices contribute to stronger vendor relationships, as suppliers are more likely to trust and prefer doing business with companies that pay promptly and accurately.

Bill Accounting's Approach to Accounts Payable Services

At Bill Accounting, we understand the complexities and challenges of managing accounts payable. Our services are designed to address these challenges head-on, offering businesses a comprehensive solution that covers every aspect of AP management. From invoice processing and payment automation to compliance and vendor management, we provide a full suite of services that enhance efficiency, accuracy, and transparency.

Our team of experienced professionals uses the latest AP technologies and best practices to deliver services that are not just about processing payments but about adding value to your business. By outsourcing your accounts payable functions to Bill Accounting, you can focus on core business activities while we ensure your financial operations run smoothly and efficiently.

Our goal is to not just manage your accounts payable but to optimize your financial operations for better efficiency, security, and strategic benefit. By partnering with Bill Accounting, you gain access to expert services that ensure your payments are processed efficiently and your cash flow is managed strategically, supporting the overall success and sustainability of your business.

By entrusting your accounts payable needs to Bill Accounting, you gain the assurance that your financial operations are not only efficient and effective but also transparent, accountable, and fully compliant with all regulatory requirements. This commitment to excellence in audit trails and compliance is a cornerstone of our service, providing peace of mind and reinforcing the trust that is so vital to successful business relationships.

Outsourcing AP functions to Bill Accounting in India can provide your business with a competitive edge, combining cost savings with access to specialized expertise and advanced technologies. As you consider outsourcing, it's important to weigh these advantages against potential challenges, ensuring that your chosen partner aligns with your business objectives and operational needs.

Bill Accounting stands out by strategically transforming AP services into assets for your business. Our tailored solutions, seasoned professionals, cutting-edge technology, and strategic financial management optimize operational efficiency. Strengthening vendor relationships, we contribute to your business's overall financial health and sustained operational excellence.

The Accounts Payable Services process involves several key steps to ensure the efficient management of financial transactions. Here's a concise overview:

This structured process ensures that accounts payable services contribute to maintaining strong financial health, optimizing working capital, and fostering positive relationships with suppliers and vendors.