Outsourcing Accounting Services (OAS) is a popular option for businesses of all sizes as it enables them to focus on their core competencies while an external provider takes care of their financial accounting and bookkeeping functions. One of the biggest advantages of OAS is the cost savings it can offer, as businesses can significantly reduce overhead costs by outsourcing accounting services. It also eliminates the need for hiring and training in-house staff. However, choosing the right service provider for OAS is crucial for its success. The provider should have the necessary expertise, experience, and technology to manage financial data accurately and securely. They should also be able to provide customized solutions that meet the unique needs of each business. A good OAS provider should have a team of trained professionals who are knowledgeable about current accounting standards and regulations. Another advantage of outsourcing accounting services is that it allows businesses to access advanced financial software and tools without having to invest in expensive technology themselves. This can help improve accuracy, efficiency, and overall financial performance. When selecting an OAS provider, it is important to conduct thorough research and due diligence to ensure that they have a good reputation in the industry, offer competitive pricing, and provide excellent customer support. By choosing the right provider, businesses can reap the benefits of outsourcing accounting services while avoiding potential pitfalls such as data breaches or inaccurate financial reporting.

Bill Accounting is a reliable provider of outsourcing Singapore accounting services to India, offering an extensive range of accounting services that include bookkeeping, payroll management, tax preparation, and financial reporting. With a decade's worth of experience in the field, their team of expert accountants is highly proficient in the latest accounting regulations and standards, utilizing advanced software and technology for maximum efficiency and accuracy. By outsourcing accounting services to Bill Accounting, business owners can benefit from industry comparisons, which demonstrate its success and expertise in the field. Additionally, there are several advantages to choosing Bill Accounting. Firstly, they offer cost-effective solutions that help businesses save time and money. Secondly, their services are scalable and customizable to suit individual business needs. Finally, business owners can have peace of mind knowing that their finances are being handled by a competent team of accountants with a proven track record of delivering exceptional results. In conclusion, outsourcing accounting services to Bill Accounting can be a smart move for businesses looking to streamline their operations while minimizing costs. The company's expert team of accountants and cutting-edge technology ensure top-notch service delivery that helps businesses stay ahead of the competition.

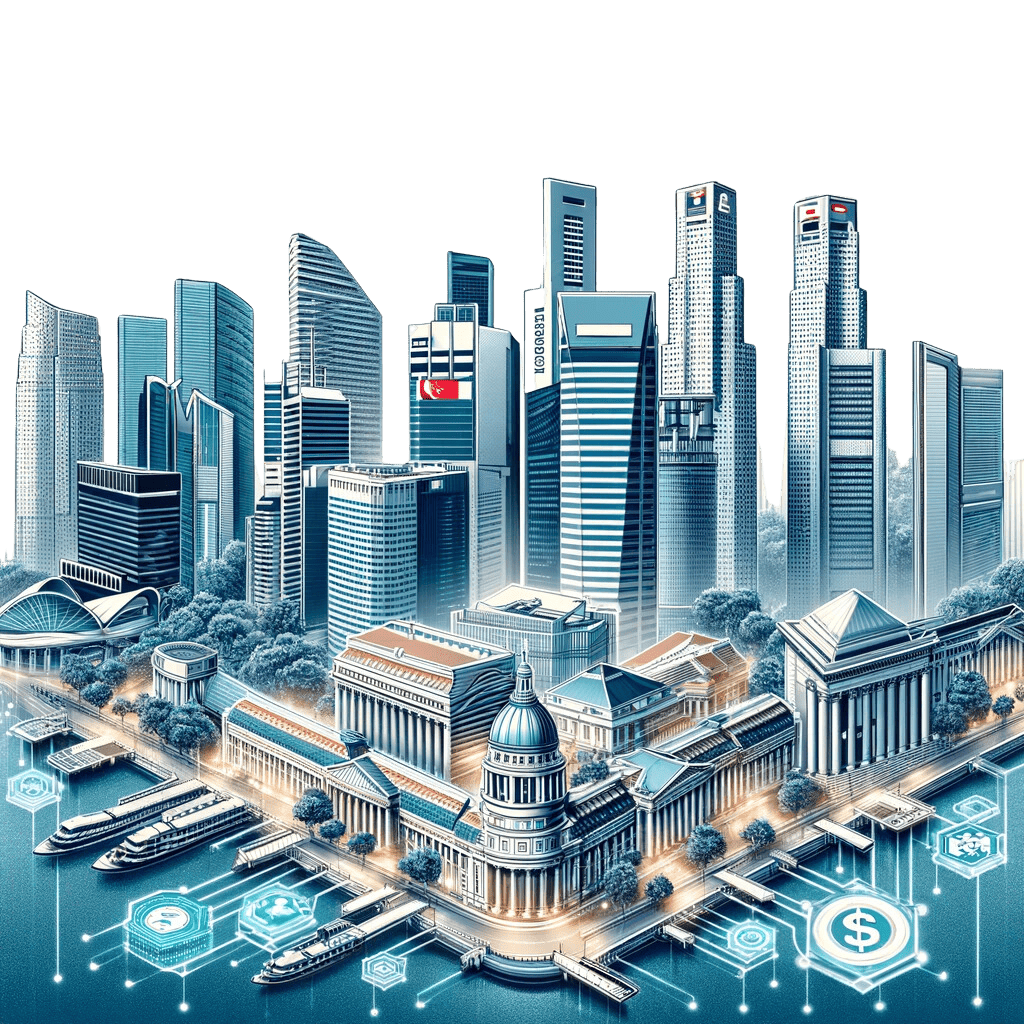

Singapore and India are both major players in the global accounting services industry. Singapore is known for its advanced financial infrastructure, while India is recognized for its skilled workforce and cost-effective solutions.

The accounting services industry in Singapore is highly developed, with a large number of local and international accounting firms operating in the country. The industry is tightly regulated, and firms need to comply with strict standards and regulations. Singapore's accounting services sector has grown significantly in recent years, driven by the country's position as a hub for global business and finance.

In contrast, the accounting services industry in India is known for its skilled workforce and cost-effective solutions. The industry has grown rapidly in recent years, with many global companies outsourcing their accounting services to Indian firms. India has a large pool of talented accounting professionals who are proficient in the latest accounting software and techniques.

When comparing Singapore and India's accounting services industries, it is clear that both have their strengths and weaknesses. Singapore offers a highly regulated and advanced financial infrastructure, while India provides a skilled workforce and cost-effective solutions.

By outsourcing accounting services from Singapore to India with Bill Accounting, businesses can leverage the strengths of both countries. They can benefit from Singapore's advanced financial infrastructure and India's skilled workforce, resulting in high-quality and cost-effective accounting solutions. Additionally, Bill Accounting's team of experts is well-versed in both Singaporean and Indian accounting regulations and can ensure compliance with all relevant standards.

Bill Accounting offers a comprehensive range of Outsourced Accounting Services (OAS) that can be tailored to meet the specific needs of businesses. Their services include bookkeeping, payroll management, tax preparation, and financial reporting, among others.

One of the key benefits of using Bill Accounting as your OAS provider is cost savings. Outsourcing accounting services to Bill Accounting is more cost-effective than hiring and training an in-house accounting team. Businesses can save on salaries, benefits, and overhead costs associated with maintaining an accounting department.

In addition, Bill Accounting provides access to skilled talent. Their team of accounting professionals has expertise in the latest accounting standards and regulations. They are proficient in using accounting software and can offer advice and guidance on financial matters.

Using Bill Accounting as your OAS provider can also save your business time. By outsourcing accounting services, you can free up your time and focus on your core business activities. This can help increase productivity and profitability.

Bill Accounting's OAS offerings are designed to help businesses of all sizes, from startups to multinational corporations. They have a proven track record of success in providing high-quality accounting services to businesses across a range of industries.

By using Bill Accounting as your OAS provider, your business can benefit from cost savings, access to skilled talent, time savings, and the ability to focus on core business activities. With their expertise and experience in the field, you can trust Bill Accounting to provide high-quality accounting services that meet your specific needs. Additionally, Osome Accounting software offers real-time financial reports, including the Profit & Loss statement and the Balance Sheet, which can help you track your business's financial health and make informed decisions.

Outsourcing Accounting Services (OAS) is a popular option for businesses of all sizes as it enables them to focus on their core competencies while an external provider takes care of their financial accounting and bookkeeping functions. One of the biggest advantages of OAS is the cost savings it can offer, as businesses can significantly reduce overhead costs by outsourcing accounting services. It also eliminates the need for hiring and training in-house staff. However, choosing the right service provider for OAS is crucial for its success. The provider should have the necessary expertise, experience, and technology to manage financial data accurately and securely. They should also be able to provide customized solutions that meet the unique needs of each business.

A good OAS provider should have a team of trained professionals who are knowledgeable about current accounting standards and regulations. Another advantage of outsourcing accounting services is that it allows businesses to access advanced financial software and tools without having to invest in expensive technology themselves. This can help improve accuracy, efficiency, and overall financial performance. When selecting an OAS provider, it is important to conduct thorough research and due diligence to ensure that they have a good reputation in the industry, offer competitive pricing, and provide excellent customer support. By choosing the right provider, businesses can reap the benefits of outsourcing accounting services while avoiding potential pitfalls such as data breaches or inaccurate financial reporting.

Bill Accounting is a reliable provider of outsourcing Singapore accounting services to India, offering an extensive range of accounting services that include bookkeeping, payroll management, tax preparation, and financial reporting. With a decade's worth of experience in the field, their team of expert accountants is highly proficient in the latest accounting regulations and standards, utilizing advanced software and technology for maximum efficiency and accuracy.

By outsourcing accounting services to Bill Accounting, business owners can benefit from industry comparisons, which demonstrate its success and expertise in the field. Additionally, there are several advantages to choosing Bill Accounting. Firstly, they offer cost-effective solutions that help businesses save time and money. Secondly, their services are scalable and customizable to suit individual business needs. Finally, business owners can have peace of mind knowing that their finances are being handled by a competent team of accountants with a proven track record of delivering exceptional results. In conclusion, outsourcing accounting services to Bill Accounting can be a smart move for businesses looking to streamline their operations while minimizing costs. The company's expert team of accountants and cutting-edge technology ensure top-notch service delivery that helps businesses stay ahead of the competition.

Singapore and India are both major players in the global accounting services industry. Singapore is known for its advanced financial infrastructure, while India is recognized for its skilled workforce and cost-effective solutions.

The accounting services industry in Singapore is highly developed, with a large number of local and international accounting firms operating in the country. The industry is tightly regulated, and firms need to comply with strict standards and regulations. Singapore's accounting services sector has grown significantly in recent years, driven by the country's position as a hub for global business and finance.

There are several reasons why Bill Accounting is the right choice for your accounting outsourcing needs. Firstly, we have years of experience in providing accounting services to businesses of all sizes. Our team of experts is well-versed in handling a variety of accounting tasks, ensuring accurate and efficient results.

Secondly, we prioritize data security and confidentiality. We understand the importance of protecting your financial information and employ industry-standard encryption and security protocols to safeguard it.

Furthermore, our services can be customized to meet your specific business needs. Whether you require bookkeeping, payroll management, tax preparation, or financial reporting, we can tailor our services to ensure that all your accounting requirements are met.

Additionally, our team is dedicated to providing exceptional customer service. We believe in building strong relationships with our clients and strive to deliver prompt responses and personalized attention. You can trust us to be available whenever you need assistance or have any questions regarding your accounting matters.

Furthermore, outsourcing your accounting needs to Bill Accounting can help streamline your business processes. By leveraging our expertise and advanced software systems, we can optimize your financial operations, improve accuracy, and provide real-time insights into your business's financial health.

Lastly, partnering with us can offer you flexibility and peace of mind. As your business grows and evolves, you can rely on us to scale our services accordingly. Whether you need additional support during busy seasons or want to expand your accounting requirements, we have the capacity to accommodate your changing needs.

Outsourcing your accounting needs to Bill Accounting can greatly increase the efficiency of your business operations. By utilizing their expertise in bookkeeping, payroll management, tax preparation, and financial reporting, you can ensure that your financial functions are handled accurately and efficiently. This allows you to focus on other core activities of your business, knowing that your accounting responsibilities are in capable hands. With their customized services tailored to your specific needs, you can streamline your financial processes and maximize productivity. Let Bill Accounting take care of your accounting tasks while you concentrate on growing your business. When it comes to managing your business's accounting needs, efficiency is key. That's why outsourcing to Bill Accounting can be a game-changer for your company. By entrusting your accounting tasks to their team of experts, you can streamline your financial processes and maximize productivity.

With a focus on customization, Bill Accounting understands that every business has unique accounting requirements. They work closely with their clients to gain a deep understanding of their needs and develop tailored solutions that fit perfectly. Whether you need assistance with bookkeeping, payroll management, tax preparation, or financial reporting, Bill Accounting has the expertise and experience to handle it all. By outsourcing your accounting needs to Bill Accounting, you can free up valuable time and resources that can be better utilized in other areas of your business. With their efficient processes in place, you can rely on accurate and timely financial data that is essential for making informed business decisions.

The strategic partnership you establish with us frees up your internal resources, allowing you to concentrate on strategic planning and decision-making, optimizing your time management during peak seasons. Take advantage of our expertise to optimize your operations, improve efficiency, and ensure sustained success in the future – Get in touch with us now!